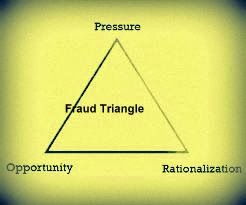

There is an accepted premise in security circles,

particularly attributable to the workplace but may be applicable here, that 10%

of people are inherently dishonest and will steal from you regardless of

security measures in place, 10% of people are inherently honest and will not steal

from you under any circumstances, but the remaining 80% are prepared to go

along with the trend or follow the herd.

In other words, most people will start to feel that theft is acceptable

under some circumstances if those in management or supervisory positions appear

to not particularly care one way or another.

Although this concept may seem like some sort of farcical generality, it

is actually based on scientific research.

And, I think it is applicable to many of the programs that are currently

administered by the federal government.

Every new administration talks the good talk about waste,

fraud and misappropriation, but they never seem to do anything about it. The only possible explanation is that, other

than rhetorically speaking, they really don’t care that much about trying to

solve the problem. Why? Perhaps any real corrective measures would be

construed as politically insensitive, lead to adverse publicity and ultimately

cost votes. That said, I do think that

the priorities of the typical politician are mostly about promoting

themselves. If one had a personality

that did not fit within those egocentric parameters, it is doubtful that said

individual would ever enter politics in the first place – and, if they did,

they probably wouldn’t last long. So,

the waste, fraud and misappropriation continues.

I would be willing to bet that most people have hedged,

misrepresented, or lied on their federal and state tax return. Some even talk freely about how they have

earned money under the table and didn’t report it or have paid someone in cash

knowing that the money would never be reported as income by the recipient. Some accept social services while

misrepresenting their actual income. Others,

those that can afford it, hire attorneys and accountants to search for arcane loop

holes in the tax code; loop holes that are not quite illegal, but certainly

circumvent the code’s purported intent for fairness.

Does the government care? It doesn’t seem to. Do you feel like something of a sucker if you

try to play by the rules? Well, no need to; go ahead and join the herd. You

shouldn’t have to feel like a sucker.

Our tax system is so complicated, convoluted and polluted that there is

no reason to even bother attempting to fully comply. The income tax system doesn’t work and the

federal government knows it. And, for

the most part, the public accepts it and its many opportunities to cheat.

Oh, right, what about my suggestions for the Social Security

Administration:

The Social Security Administration has a database for

deceased persons already in place, but they claim it is not entirely

accurate. Fix it. We do not live in a Third World country – at

least not so far. People do not

generally pass-on anonymously. If one

does, he or she should be checked through the SSA database. How about getting a thumb print from everyone

who signs-up for Social Security, Medicaid or Medicare? No thumb print, no federal money. Or, could it be said that thumb prints

discriminate against minorities and the poor – an invasion of privacy? No, not really – but it will / does discriminate

against those intent on cheating the system.

How about those receiving federal payments being required to

certify annually that they are still entitled to benefits, and that the

residence and banking information is accurate.

If the SSA can’t contact the recipient through normal channels, stop

sending money to a bank account – or require the bank to contact the recipient. Compliance with the law shouldn’t be that

difficult. If recipients have the

where-with-all to sign up for public benefits, they should certainly have the

where-with-all to comply with certain requirements for continued payments.

How about prosecuting those that commit fraud? I suppose it goes without saying that enforcement

would require a good-faith effort to investigate potential fraud? But, as we know, the relevant federal agencies

always cite lack of resources for investigative efforts while they squander

hundreds of millions of the taxpayers’ dollars.

Although the Fahrenthold article states the amount of theft from the

government in dollars, he fails to note how many prosecutions resulted. I would be willing to bet that the number of

arrests and convictions is very small.

If the SSA, can’t handle the investigations (odd, don’t you think,

considering the thousands of employees within their organization), how about

turning it over to a private contractor to prepare preliminary investigations

of wrong-doing? Let the contractor be

paid based on projected savings and recoveries.

I could go on, but I will jump to the bottom line. Our governments, state and federal, have

almost unlimited resources. Self-serving

politicians buy votes by doling out money to various voting blocks. When the tax dollars run short, politicians

simply ask for or demand more tax revenue citing potential, largely fabricated,

dire circumstances. Honest citizens, hardworking

citizens get ‘hosed’ in the process. It

is as simple as that.

In my opinion to minimize fraud, in addition to the above:

Greatly reduce or eliminate the current corporate tax, with

all the associated, phony tax exemptions now used by corporations. Corporations do not pay taxes. People pay taxes. If a corporation pays a tax, it must pass it

on to the consumer, or go out of business.

The public should understand that corporate taxes are a hidden tax on

the uninformed consumer.

Discontinue income tax reporting for those earning less than

$1 million per year. Go to a national

‘value added tax,’ which is a consumer tax similar to a sales tax. If you buy something you pay a tax. If you want to save your money for

retirement, your kids’ education, etc., you don’t pay any taxes on those

dollars. You can just stash your money

or invest it. Necessities, like food,

would be exempt from taxation. Such a

system would instantly include all the tax freeloaders like those ‘working

under the table,’ drug dealers and others involved in criminal activities, as

well as the reported 50% of American citizens who currently do not pay any

income taxes.

I know this is overly simplistic; but my point is we need a

fair, transparent tax system with easy compliance and required enforcement - but does, nonetheless, make it difficult to cheat.

Let’s all join the

10% of inherently honest people.

True Nelson